Enter email to continue to Scientific Investing.

SIMBA (Scientific Investing Market Breadth Analyzer) is our SYSTEM which we offer as data as a service. SIMBA (The SYSTEM) helps to identify data driven market patterns and insights at index, sector, industry and stock level for investing and trading research ideation and monitoring

Plans for everyone's need

Avail upto 38% discount on annual plans

This is suitable for those who have foundational fundamental and technical analysis knowledge and look for various company and sector case studies with productivity tools and systems for stock market tracking

Key Benefits:

80+ hours of additional content covering these 3 courses:

Very Important:

* SIMBA Access and TradingView Indicators Access

* Stock Analysis Excel Tool

* Competitive Analysis Excel Tool

* Supersessions on multiple sectors, valuation, Chartink...

Terms & Conditions:

Price includes 18% GST

Subscription fees are non-refundable.

Tradingview indicator access is valid till tradingview allows it. In case tradingview stops publishing of indicators based on external data, we will not be able to provide this feature. Please check FAQ for more details

Read further to know Why SIMBA and successful investing and trading use cases

| Basic | Pro Downgrade |

Pro+ Current |

Premium Upgrade |

|

|---|---|---|---|---|

| Ad-free | ||||

| Charts | ||||

| Social Network | ||||

| Charts | ||||

| Charts Per Tab | 1 | 2 | 4 | 8 |

| Number of Saved Charts Layouts | 1 | 5 | 10 | 00 |

| Custom time intervals | ||||

| Second based intervals | ||||

2000+ companies, 100+ industries. 15+ sectors, 5+ indexes. At any point of time, interesting potential ideas are few for focused research. One who knows, raises research productivity 10x. Want to know, ask SIMBA

Most of SIMBA investing insight updates are at monthly frequency unless any outlier event occurs. Want to research and invest with peace away from daily level noise, ask SIMBA

Humanly impossible to track every stock, industry, sector, index and market for opportunity identification as an individual, ask SIMBA

No emotional bias, No verbal bakwas.Want a data driven alternate source of truth to control own biases during greed and fear times, ask SIMBA

Monthly tracking of key index, ETFs and Indian markets for investing signal insights. Helps to decide on opting right market segments or staying out

Monthly tracking of stocks covering 75% of market cap universe to identify new stock trends emerging and trends fading along with in momentum stocks and out of momentum stocks

Monthly tracking of all the sectors to identify new sectoral trends emerging and trends fading along with in momentum sectors and out of momentum sectors

Algorithms to filter interesting charts for technofunda investing and positional trading for reversal bets for detailed research

Monthly tracking of all the industries to identify new sectoral trends emerging and trends fading along with in momentum industries and out of momentum industries

Algorithms to filter interesting charts for technofunda investing and positional trading for momentum bets for detailed research

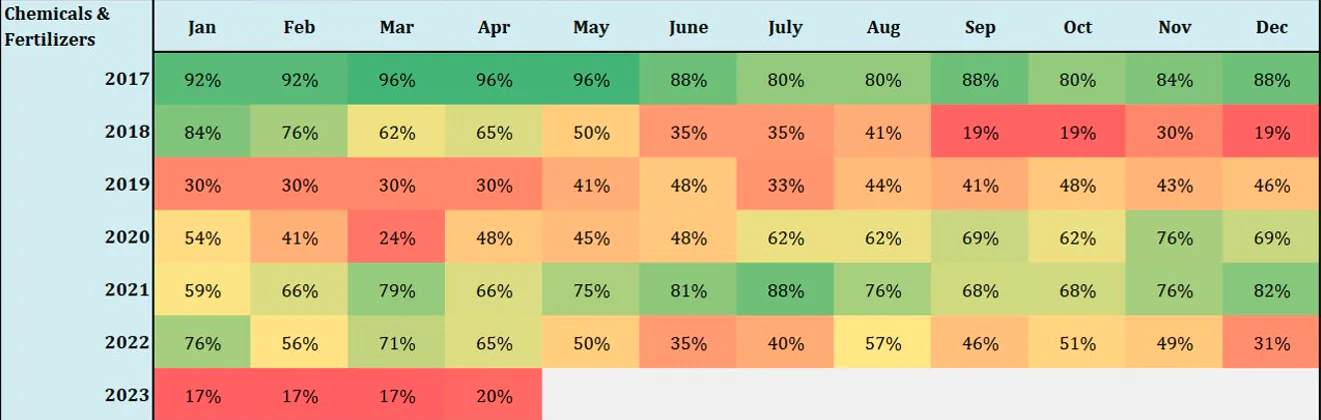

Research to ride sectors at right time (green in) and let system caution (red out) for any holding biases by generating warning signals

Research to ride stocks at right time (green in) and let system caution (red out) for any holding biases by generating warning signals

Hi Friends,

In 16 years of investing journey, gone through own share of greed, fear, anxiety and happiness, the more time I spent in the market, the more I became sure about developing a strong process wired around a well tested guiding system and following it utmost discipline. The system provides an independent view away from human biases and emotion, purely based on data, to act as devil’s advocate, guiding force, productivity enhancer and idea generator with peaceful and focused mind. A powerful process helps to build repeatable, successful set of actions for research leading to successful and impactful outcomes. Discipline is needed to extract best out of a good system and process. In my investing universe, SIMBA (Scientific Investing Market Breadth Analyzer) acts as the guiding system.

I have taken multiple hats including Financial due diligence consultant working with reputed organizations (ICRA, EY etc.), Data Scientist (being one of top 40 under 40 data scientists working with companies like HP, DXC, Vmware), Teacher (guest faculty at various schools including IIT Jodhpur, Willey, IIMs, Manipal UNext, Praxis Business School), Entrepreneur and Educator (Founder, Scientific Investing with 2000+ subscribers and 29K+ subscribers on Youtube channel)

While building SIMBA , I have tried to bring all these various skills together leveraging market, data science and teaching knowledge. With opening SIMBA for public consumption, it is my earnest effort to share a world class investing and trading SYSTEM to enhance research productivity. We have lot of more exciting feature pipeline around SIMBA which we would like to add in coming months. Also, we are offering 1-month free access to SIMBA with all the features so that you understand if it is something useful for you. Do give it a try. Best wishes for your investing and trading journey.

Regards,

Saurabh

We have been sharing our views on markets over various platforms including:

Frequently Asked Questions